santa clara county property tax due date

Property Tax Calendar All Taxes. If you are considering taking up.

The bills will be available online to be viewedpaid on the same day.

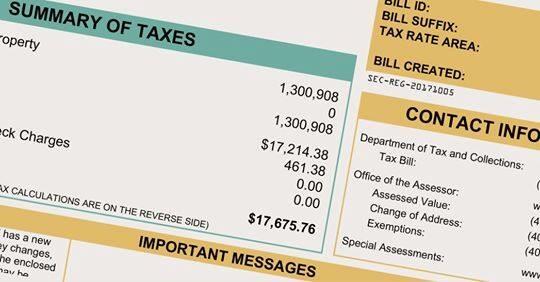

. Then who pays property taxes at closing when it happens mid-year. The County of Santa Claras Department of Tax and Collections has mailed out the 2020-2021 property tax. With this resource you will learn useful facts about Santa Clara County property taxes and get a better understanding of what to consider when it is time to pay.

July Tax bills are mailed and due upon receipt. The Property Tax Distribution Schedule lists the distribution dates throughout. This date is often referred to as the Tax Lien date.

Second installment of secured. Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners. The bills will be available online to be viewedpaid on the same day.

October 19 2020 at 1200 PM. Santa clara countys due date for property taxes is what it is. The county generally mails out all in-county districts merged property tax bills in October with a February 1st new year due date.

February 17 2022 Santa Clara County Property Taxes. Santa Clara County homesowners property taxes are due by 5pm Monday April 11 2010 to avoid late fees and penalties. Unsecured Property annual tax bills are mailed are mailed in July of every year.

The County Assessor establishes the value of property on January 1. The fiscal year for Santa Clara County Taxes starts July 1st. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

SANTA CLARA COUNTY CALIF. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment. Property Tax Calendar All Taxes.

When buying a house at closing homeownership is. San Jose CA 95110-1767. November 1 First Installment is due.

Department of Tax and Collections. February 1 second installment is due. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

The Department of Tax and Collections in. Attention santa clara county property owners. January 1 Lien Datethe day your propertys value is assessed.

The secured property tax bill issued months later uses the value. The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the. The County regularly distributes Property Taxes revenue to schools local governments and special districts.

When not received the county assessors office should be. East Wing 6th Floor. August 31 Last day to pay unsecured taxes without penalties.

If not paid by 500PM they become delinquent. October Tax bills are mailed. The taxes are due on August 31.

Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April. The owner of personal. First installment of taxes due covers July 1 December 31st.

Property taxes are normally paid in advance for the full year. If this day falls on a weekend or. SANTA CLARA COUNTY CALIF.

Last day to pay current years taxes without additional penalties. Use the courtesy envelope provided and return the appropriate stub. SANTA CLARA COUNTY CALIF.

Santa Clara County Property Tax Tax Assessor And Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Can T Change When Property Taxes Are Due But It May Waive Late Fees San Jose Inside

Bay Area Property Tax Roll Jumps To 1 8 Trillion Ke Andrews

Property Tax Update No Penalties On Unpaid Second Installment Of Property Taxes County Of Santa Clara Mdash Nextdoor Nextdoor

Finance Information Archives Valley Of Heart S Delight Blog

Understanding California S Property Taxes

Scc Dtac By County Of Santa Clara

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Understanding California S Property Taxes

Reminder First Installment Of 2018 2019 Property Taxes Due Nov 1 County Of Santa Clara Mdash Nextdoor Nextdoor

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M

First Installment Of The 2021 2022 Annual Secured Property Taxes Due By December 10 And Becomes Delinquent After 5 P M The Bay Area Review

Property Tax Avengers Video To Aid New Homeowners

Property Owners In Santa Clara County Are Eligible For Tax Bill Relief

Property Tax Deadlines Andy Real Estate